Pair Trading ETH-BTC Analysis

10-Oct-2022

Let's be frank, macros a mess right now. I find myself unwilling to bet money to the upside nor the downside. I am, however, comfortable averaging in for the long term but deploying full 100% to the long side is just downright scary right now. Therein lies the problem - having sidelined capital just feels inefficient.

In an attempt to deploy more capital to work, over the past few days, I did further analysis on going long ETH while eliminating market exposure by shorting an equivalent dollar amount of BTC - pair trade. My initial approach was a naive one - perpetually going long on ETH and short on BTC with a stop loss at 1% and reopening positions the next day (12am UTC). The findings were suboptimal.

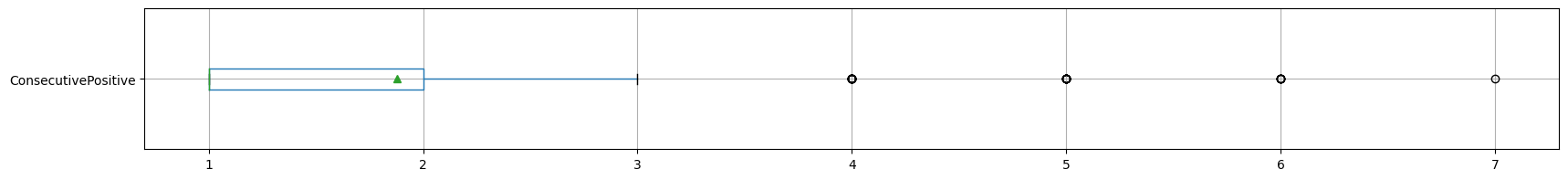

Hence, I did some statistical analysis and found that the median consecutive days ETH outperforms

BTC to be 1 and the mean to be around 1.8. Here's a boxplot for consecutive positive days for

ETHBTC (aka filtered only positive ETHBTC days).

you can find the full analysis below.

you can find the full analysis below.

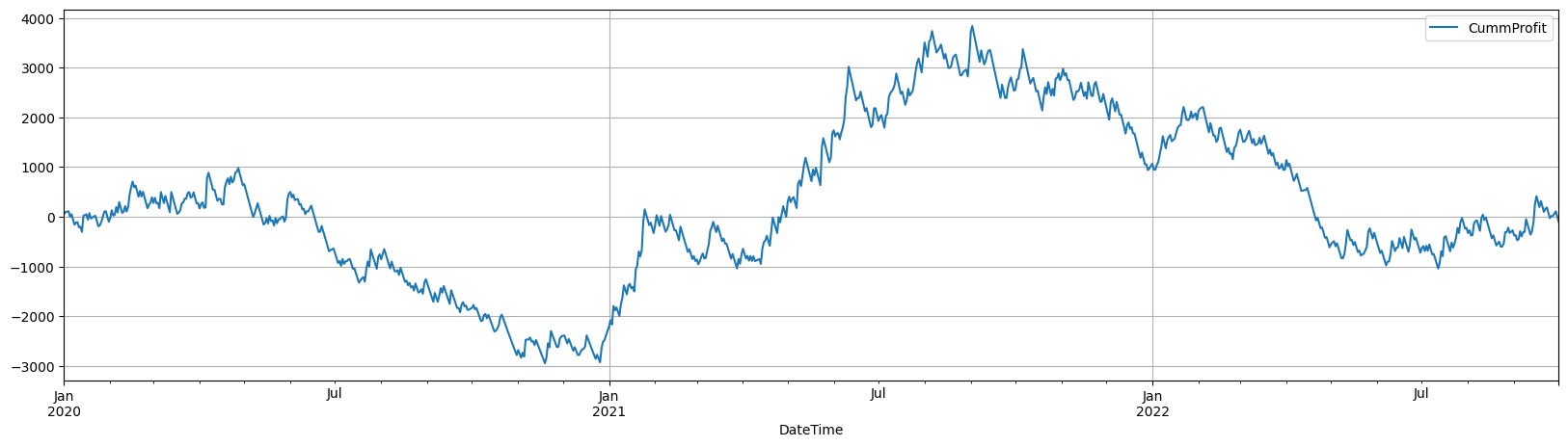

With these findings, I decided to model the returns if I alternate between ETH long; BTC short and BTC long; ETH short after 1 and 2 consecutive winning trades.

My findings were still discouraging. Here's the summary of my finding for 2 consecutive days from 1 Jan 2020 - 1 Oct 2022:

ETHBUSD - BTCBUSD Pair Trade

Hodl ETH

Pair Trade

Start: 10000; End: 9897.704385000005

Returns: -102.29561499999545 (-1.0229561499999544%)

Max Drawdown: -35.7283426716878%

Max Cash: 13835.748823000013

Min Cash: 7058.029973000009

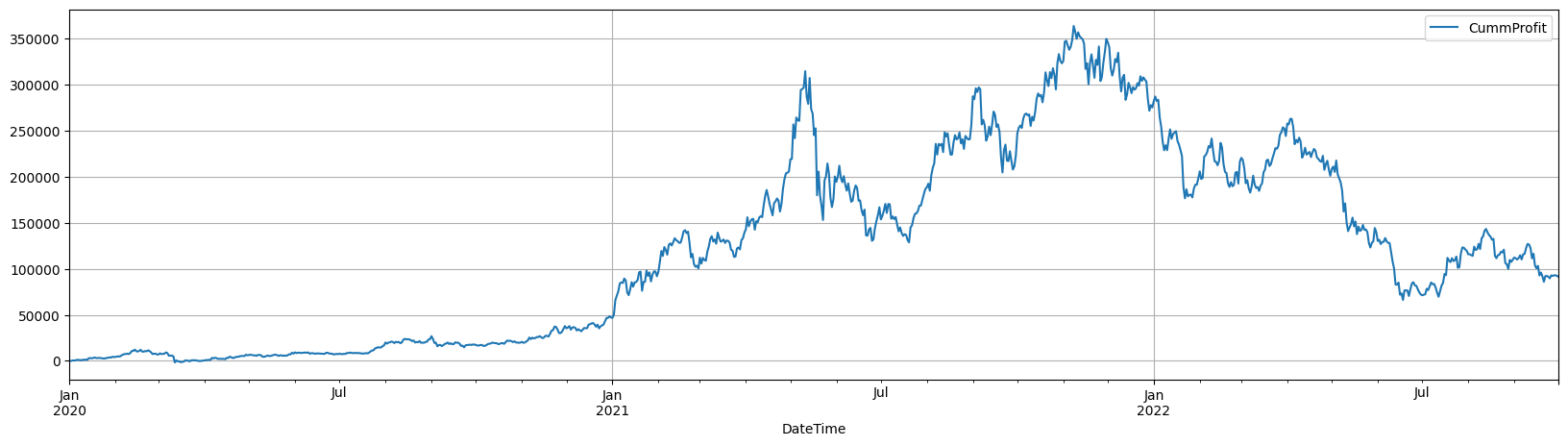

Hodl

Start: 10000; End: 100981.01758207595

Returns: 90981.01758207595 (909.8101758207595%)

Max Drawdown: -79.61402340009151%

Max Cash: 373689.12400809064

Min Cash: 8358.487630309635

As we can see, even after close to ~10 months (dec 2021 - oct 2022) of declining prices, had you bought ETH (in Jan 2020) prior to the March 2020 crash, you are still better off just hodling than pair trading.

This finding does not discount pair trading as a viable strategy. It just means (i) the parameters to the strategy does not work and (ii) a more discretionary approach (when to long what and when to short what) might work better (but discretion == opinion). If you have ideas on how to tweak the parameters to this experiment, ping me @joshZteng

Anyhow, here's the backtest output from Jupyter notebooks:

And, here's the statistical analysis of ETHBTC: